When it comes to keratoconus (KC), the last thing you want to deal with is insurance issues. Many individuals often find themselves facing denials for either crosslinking (CXL) or contact lenses, both of which can cause serious financial setbacks. In hopes of alleviating some of your stress, we have put together this toolkit to help you navigate through any insurance issues you may be experiencing.

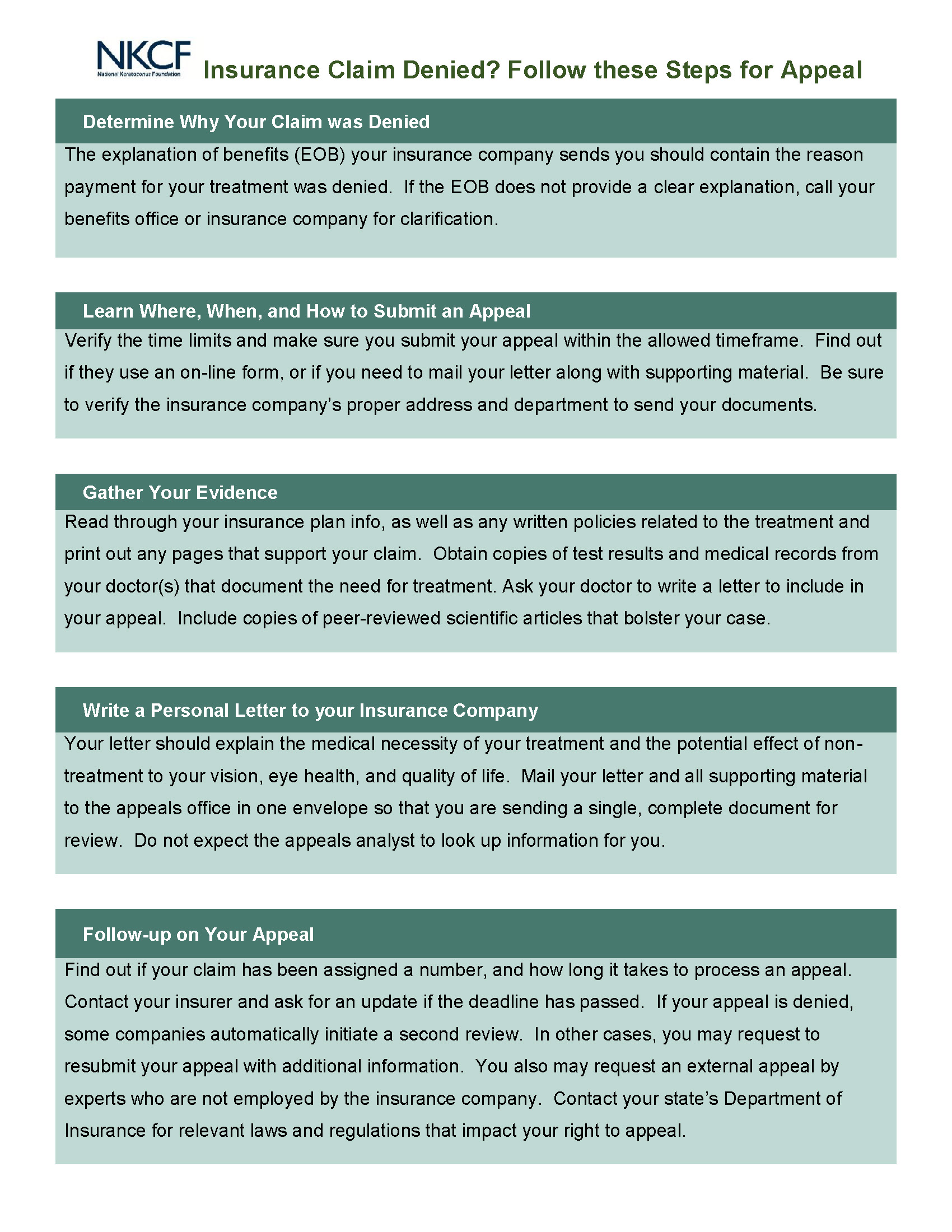

Steps to Appeal Denied Claim